HIGHLIGHTS

- Manufacturing sales rose 10.7 per cent to $40.2 billion in May.

- Sales increased in 9 of 11 major industries, headlined by a substantial rebound in motor vehicles and parts.

- Sales were up in 8 of 10 provinces, led by Ontario and Quebec.

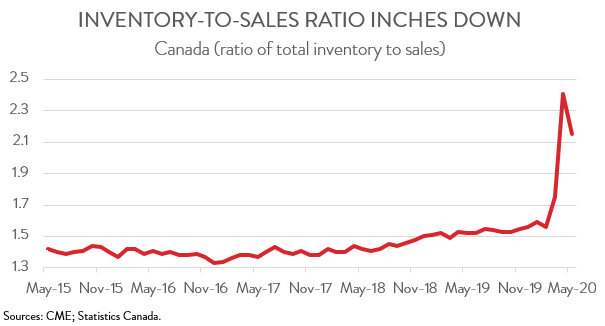

- The inventory-to-sales ratio inched down from a record 2.41 in April to a still elevated 2.15 in May.

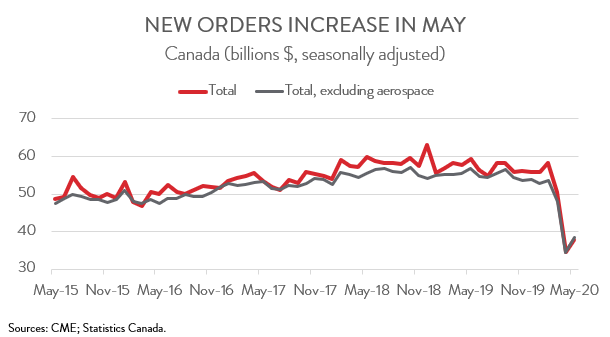

- Forward-looking indicators were mixed: new orders rose 9.4 per cent, while unfilled orders dipped 2.4 per cent.

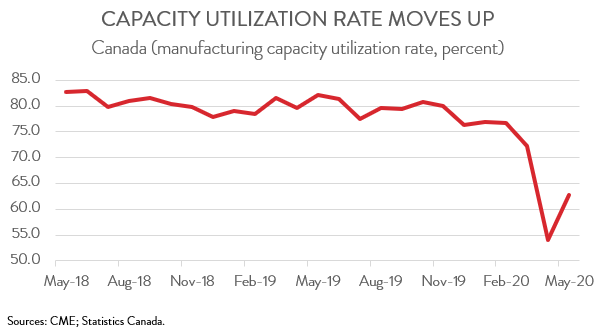

- The industry’s capacity utilization rate increased 8.8 percentage points from 54.0 per cent in April to 62.8 per cent in May.

- Today’s manufacturing sales report was yet another sign that May marked the turning point for the economy. However, despite this good news, the manufacturing industry still faces a long uphill battle to get back to pre-pandemic levels, especially with rising COVID-19 cases in the US, Canada’s largest trading partner, jeopardizing its economic recovery.

MANUFACTURING SALES INCREASE 10.7 PER CENT IN MAY

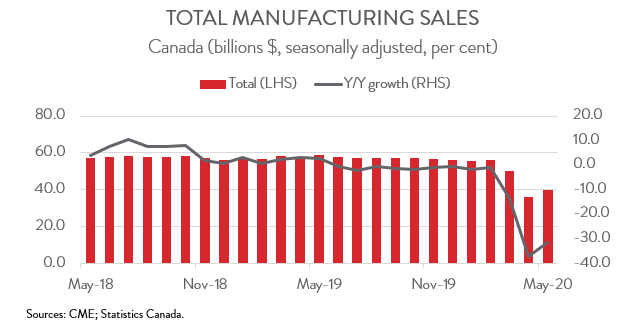

After suffering a record 27.9 per cent decline in April, manufacturing sales started to turn around in May, rising 10.7 per cent to $40.2 billion. However, even with this gain, factory sales in May were 28.4 per cent below their pre-crisis levels in February. After removing the effect of prices, manufacturing volumes rose 8.8 per cent.

Today’s manufacturing sales report was yet another sign that May marked the turning point for the economy. However, despite this good news, the manufacturing industry still faces a long uphill battle to get back to pre-pandemic levels, especially with rising COVID-19 cases in the US, Canada’s largest trading partner, jeopardizing its economic recovery.

GAINS BROAD-BASED ACROSS 9 OF 11 MAJOR INDUSTRIES

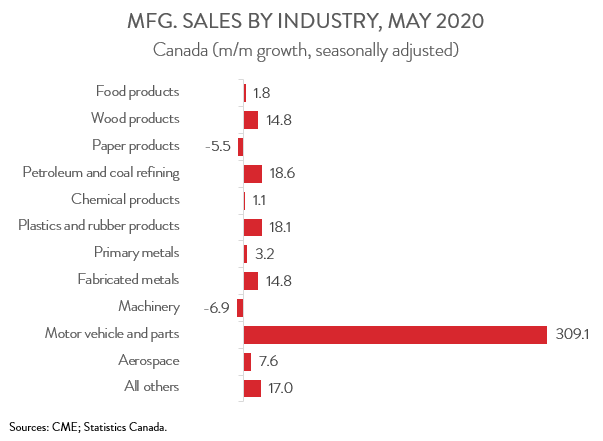

Sales were up in 9 of 11 major industries, headlined by a substantial rebound in motor vehicles and parts. Specifically, sales rose an astonishing 309.1 per cent in May, reflecting the resumption of production in the auto industry. However, despite this monthly increase, sales of motor vehicles and parts in May were 75 per cent below their February level.

Sales in the petroleum and coal products industry increased for the first time in five months in May, climbing by 18.6 per cent to $2.4 billion. This increase was attributable to both higher volumes and prices, as refineries ramped up production to meet rising demand as provinces across Canada began reopening their economies.

Three other major industries also enjoyed double-digit gains: plastics and rubber products (18.1 per cent), fabricated metal products (14.8 per cent), and wood products (14.8 per cent). The architectural and structural metal industry had a particularly strong month, thanks to the fact that many provinces moved to allow all construction work to resume in May.

On the negative side, sales in the machinery industry fell four the fourth straight month in May, down 6.9 per cent. According to Statistics Canada, the decline was attributable to some customers postponing orders due to COVID-19. At the same time, sales of paper products fell for the second consecutive month, down 5.5 per cent. This decline was attributable to lower demand from many corporate offices, shopping malls, and restaurants.

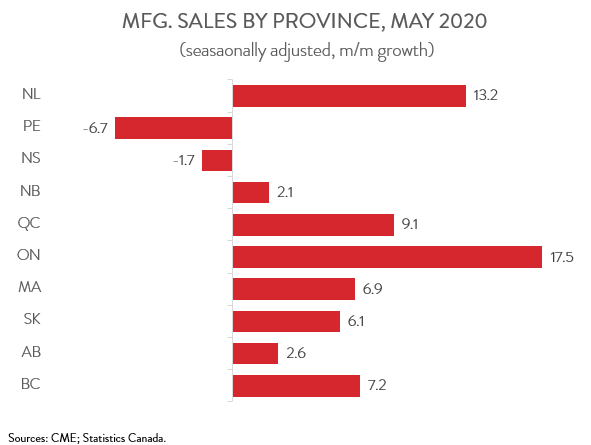

SALES UP IN 8 OF 10 PROVINCES

Manufacturing sales climbed in 8 of 10 provinces in May, led by Ontario and Quebec. Sales in Ontario rose 17.5 per cent to $16.4 billion, thanks largely to higher sales of motor vehicles and parts. In Quebec, sales climbed 9.1 per cent to $10.6 billion, led by gains in fabricated metal products, wood products, and transportation equipment. Gains in the other provinces ranged from 13.2 per cent in Newfoundland and Labrador to 2.1 per cent in New Brunswick. On a negative note, sales fell by 6.7 per cent and 1.7 per cent, respectively, in PEI and Nova Scotia.

INVENTORY-TO-SALES RATIO INCHES DOWN

Inventories fell for the second straight month in May, down 1.5 per cent. This, combined with the rise in sales, allowed the inventory-to-sales ratio to inch down from a record 2.41 in April to a still elevated 2.15 in May.

NEW ORDERS RISE, UNFILLED ORDERS FALL

Forward-looking indicators were mixed. New orders increased by 9.4 per cent to $37.8 billion in May, the first increase since February, mostly due to higher orders of transportation equipment. On the other hand, unfilled orders fell for the second straight month, down 2.4 per cent to $95.4 billion. This decline was largely attributable to lower unfilled orders in the aerospace product and parts industry.

CAPACITY UTILIZATION RATE HEADS BACK UP

Finally, with some manufacturers resuming operations following full or partial shutdowns, the industry’s capacity utilization rate increased 8.8 percentage points from 54.0 per cent in April to 62.8 per cent in May. This is still well below February’s rate of 76.8 per cent.

ABOUT THE ECONOMIST

| Alan Arcand Chief Economist Canadian Manufacturers & Exporters |

| Alan is a member of the National Policy team where he is responsible for developing and executing CME’s major national research projects, conducting CME’s macroeconomic analysis to support the organization across the country, leading our tax policy efforts, and be a leading voice representing the interests of the association and members with government and with the public. Before joining CME, Alan spent 19 years at The Conference Board of Canada where he held multiple roles, including the Associate Director of the Centre for Municipal Studies. Alan’s background includes expertise in municipal, regional, and national economic matters including economic forecasting and analysis.

| |